Patent Collateral – complying with U.C.C. Article 9

U.C.C. Article 9 and Patent Collateral: Why Secured Transactions Demand More Than a Filing

“Perfecting a security interest in patents under Article 9 is easy—unless you want it to actually hold up in court.”

In today’s economy, patents are increasingly used as collateral in secured financing arrangements. From working capital lines for biotech startups to structured loans against pharmaceutical royalty streams, intellectual property has become a critical asset class for lenders. But with this growing trend comes a growing risk: missteps under Article 9 of the Uniform Commercial Code (U.C.C.) can jeopardize the entire transaction.

For executives, lenders, and counsel involved in IP-backed lending, understanding how Article 9 governs security interests in patents is essential—not just for compliance, but for enforceability.

What Is Article 9?

Article 9 of the U.C.C. governs secured transactions, specifically the creation, perfection, and enforcement of security interests in personal property—including intangible assets such as intellectual property.

When a lender extends credit secured by a borrower’s patents, that lender must attach and perfect its interest to ensure priority over other creditors or future transferees.

👉 Model U.C.C. Article 9 Text (Uniform Laws Commission)

Are Patents Covered by Article 9?

Yes—and no.

-

U.S. Patents are federal rights governed by Title 35 of the U.S. Code

-

But security interests in patents (like other forms of intangible property) are governed by Article 9, unless the interest is recorded directly with the USPTO

This creates a dual regime:

| Mechanism | Purpose | Where to File |

|---|---|---|

| U.C.C.-1 Financing Statement | Perfects the security interest under state law | Secretary of State (debtor’s state of incorporation) |

| USPTO Recordation of Security Agreement | Puts third parties on notice under federal patent law | USPTO Assignment Recordation |

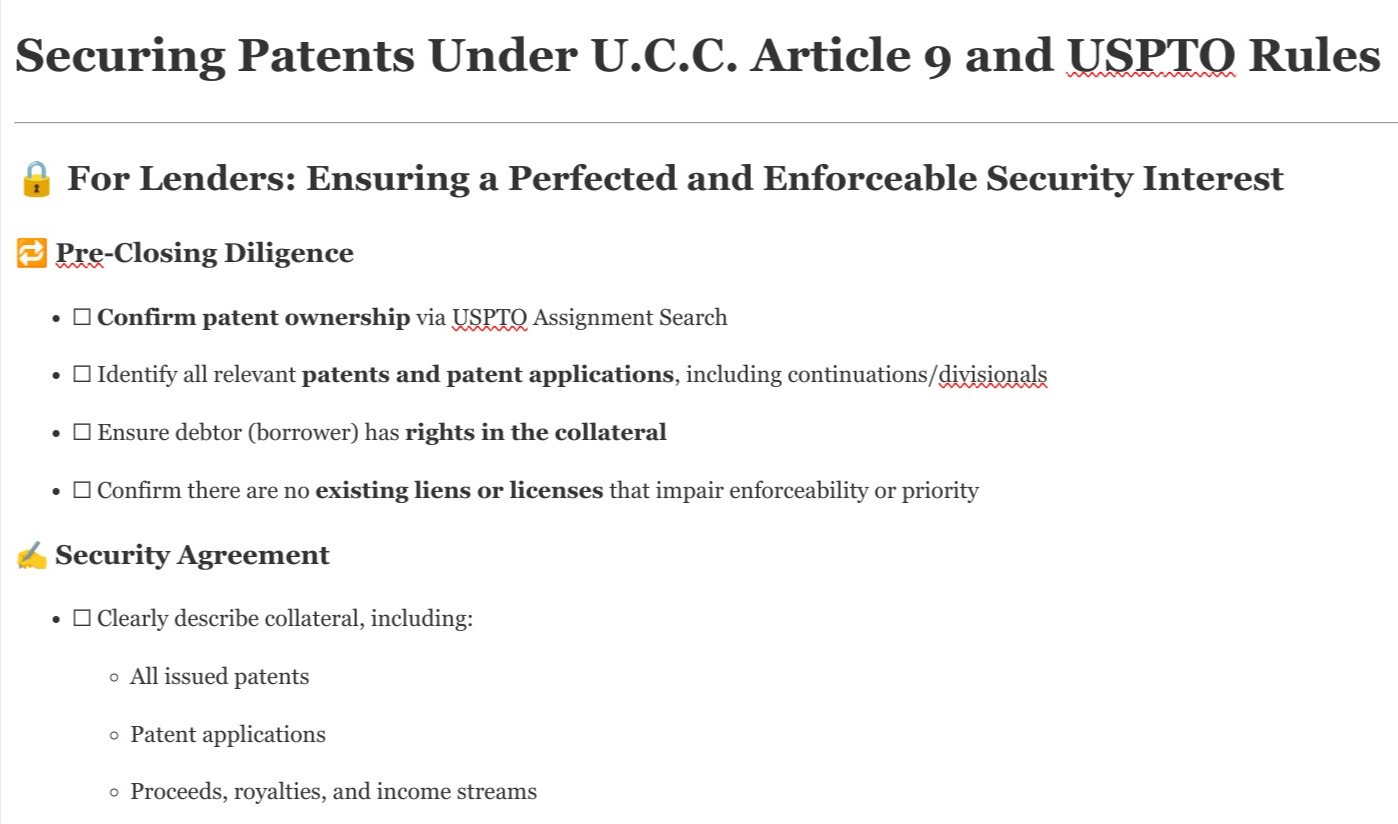

Best practice: Do both. File under Article 9 and record with the USPTO.

Key Article 9 Concepts for Patent Collateral

1. Attachment

A security interest “attaches” when:

-

Value is given (i.e., the loan is made)

-

The debtor has rights in the collateral

-

There is an authenticated security agreement describing the patents

2. Perfection

To be enforceable against third parties, the lender must perfect its security interest. This usually means:

-

Filing a U.C.C.-1 financing statement

-

Describing the collateral broadly or by category (e.g., “all general intangibles, including patents”)

“Without perfection, your lien may be subordinate—or worthless—in bankruptcy.”

3. Priority

Article 9 follows a first-to-file rule: the first creditor to perfect its interest typically has priority over later creditors.

But if another creditor records a security interest with the USPTO, and you don’t, you may lose priority even if your U.C.C. filing was earlier.

“Priority fights are won or lost not just in state records, but at the USPTO.”

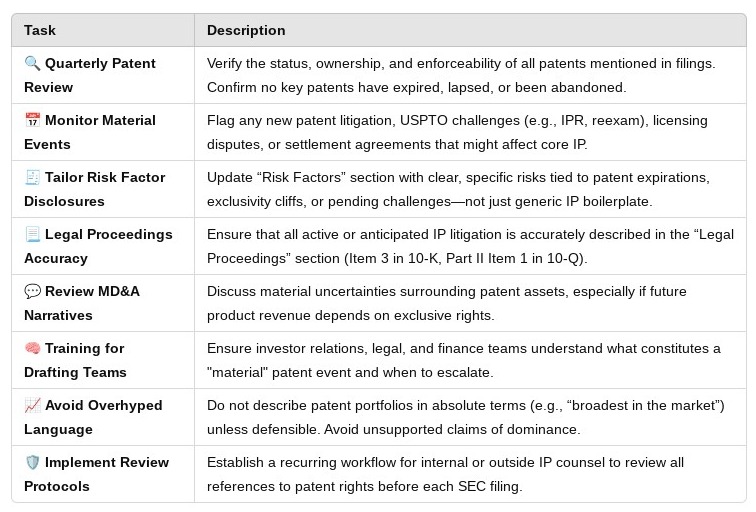

Common Pitfalls When Patents Secure Loans

❌ Filing a U.C.C.-1 Without a Security Agreement

The financing statement alone doesn’t attach the interest—there must be a signed agreement describing the collateral.

❌ Listing Patents Without Verifying Ownership

Debtors often include patents they don’t actually own, or that are owned by affiliates. Article 9 requires the debtor to have rights in the collateral.

❌ Relying Only on the U.C.C. Filing

Federal case law suggests that recording at the USPTO is necessary to put bona fide purchasers or licensees on notice.

❌ Overbroad or Vague Collateral Descriptions

Descriptions like “all IP” may not withstand scrutiny unless defined clearly in the security agreement.

What Happens in Bankruptcy?

Under the Bankruptcy Code, a perfected security interest in patents may be enforceable, but only if the creditor followed Article 9 procedures and—ideally—recorded with the USPTO as well.

Unperfected interests may be avoided by the bankruptcy trustee, or subordinated to newer, properly perfected liens.

“Bankruptcy court is no place to discover your U.C.C. filing wasn’t enough.”

Best Practices for Securing Patents Under Article 9

-

Identify and Verify Ownership

Review the USPTO’s Assignment Database to confirm the debtor’s title to each patent. -

Execute a Clear, Specific Security Agreement

Include an attached schedule of patents and define “patent rights” to include applications, renewals, and proceeds. -

File the U.C.C.-1 Promptly and Properly

File in the debtor’s state of incorporation, using accurate legal names and appropriate collateral language. -

Record the Security Interest with the USPTO

File a confirmatory security agreement as an assignment to provide federal notice and protect against third-party challenges. -

Monitor Maintenance Fees and Ownership Changes

A lien on an expired or reassigned patent may be legally worthless. Include covenants requiring borrowers to maintain their patent rights.

When patent portfolios are used as loan collateral, a sloppy U.C.C. filing or a missing USPTO recordation can render your security interest unenforceable—or worse, subordinate to another party’s.

Article 9 compliance isn’t just technical—it’s strategic. It determines whether your lien will survive a sale, a refinancing, or a bankruptcy. And in a world where innovation is often the borrower’s only true asset, getting this right is essential.

“Perfect the lien. Record the interest. Protect the value.”

Further Reading and Resources:

Additional Insights

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua