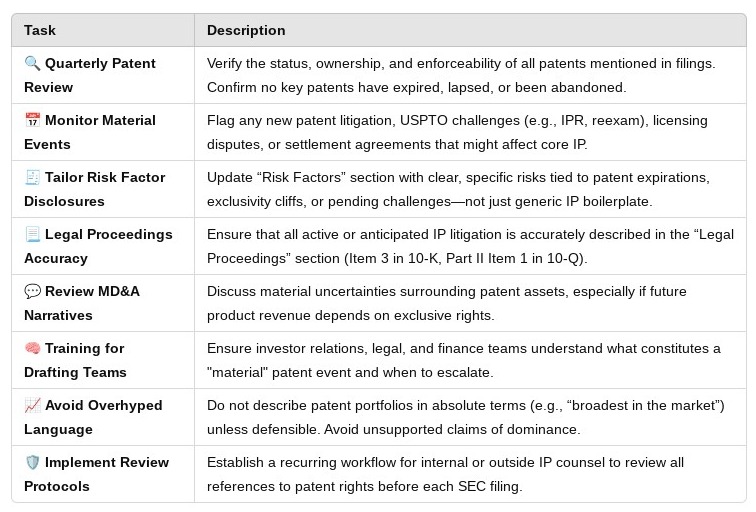

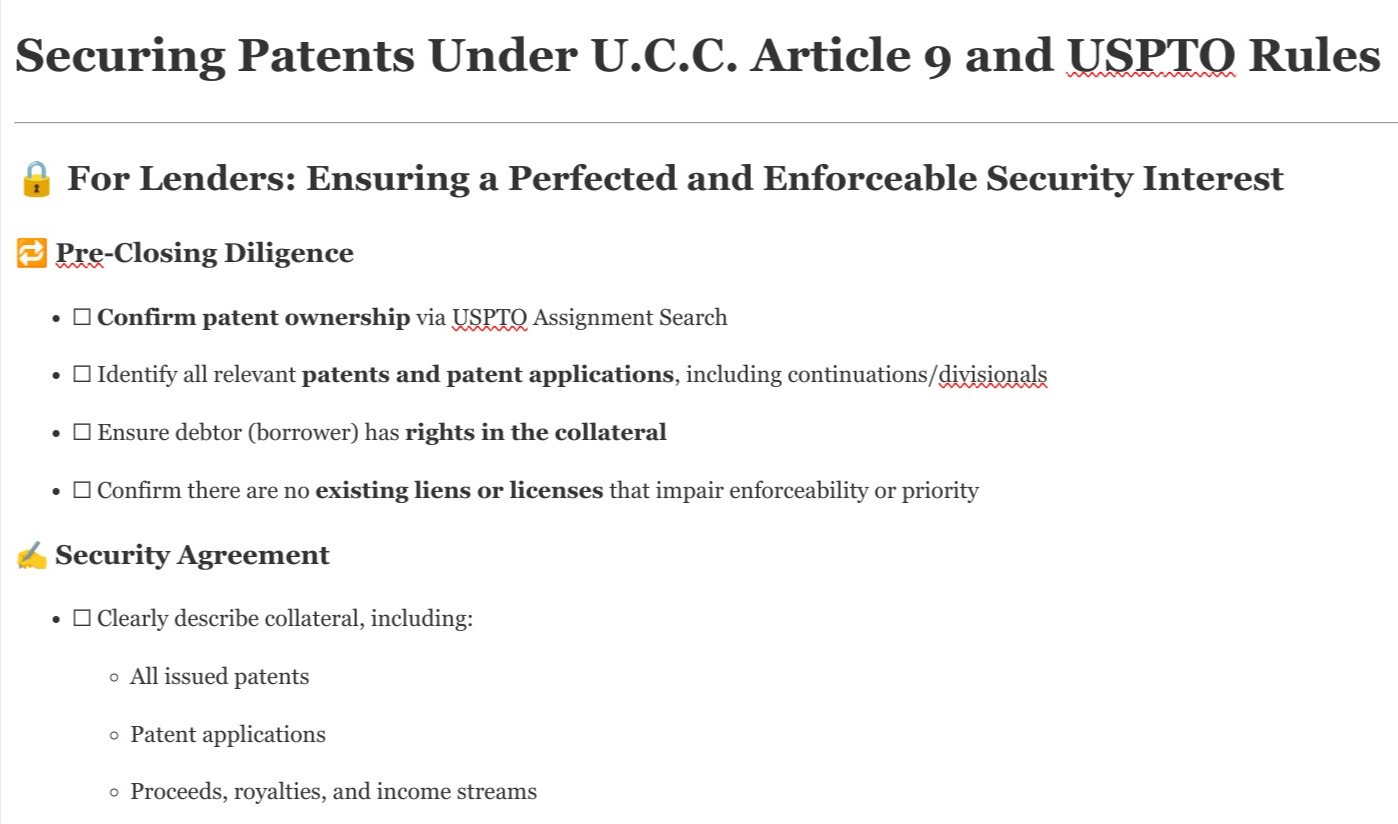

Since the public and the law trust SEC examiners to ensure credit funds and investment advisers comply with regulations designed to ensure that collateral securing loans is indeed valid—meaning it exists, is owned by the borrower, remains unexpired, and continues to meet these conditions—their role is central to maintaining institutional accountability and mitigating enforcement risk. PatenTrack equips examiners with tools to detect lapses in patent collateral oversight before they become systemic or actionable.

Patent-backed lending presents a hidden but material risk to financial reporting and investor confidence. PatenTrack helps SEC examiners surface these issues and ensure that what is represented as "secured" credit is in fact fully supported by enforceable collateral.

Defective title chains are a silent killer of patent value. Real-world cases like Ethicon and Tri-Star underscore the financial and legal fallout of oversight.