Sarbanes-Oxley Act of 2002 and Patents

“Under Sarbanes-Oxley, a misstated patent isn’t just a legal problem—it’s an executive certification risk.”

In the pharmaceutical, medtech, and technology sectors, patents aren’t peripheral—they’re often the backbone of enterprise value. Whether representing core product exclusivity, future licensing revenue, or regulatory protections, patents frequently show up in a company’s financial disclosures as high-value intangible assets.

What many executives overlook is that these disclosures are now squarely within the regulatory reach of the Sarbanes-Oxley Act of 2002 (SOX)—a statute designed to hold senior management personally accountable for the accuracy of public financial reporting.

If your company’s financial statements or risk disclosures include patent portfolios, Sarbanes-Oxley requires more than just truth—it demands verified, internal control–backed accuracy.

What Is SOX—and Why It Matters for Patents

The Sarbanes-Oxley Act was passed in response to high-profile corporate accounting scandals (Enron, WorldCom) to restore trust in U.S. capital markets. While initially focused on preventing revenue manipulation, SOX’s reach now applies broadly to any material financial misstatement or failure in internal controls.

When a company publicly reports patent portfolios—whether as capitalized intangible assets, valuation components in M&A deals, or strategic risk factors—those disclosures must be:

-

Accurate

-

Supported by proper documentation

-

Governed by effective internal controls

Two Key Sections: Executive Certification and Internal Controls

Section 302: CEO and CFO Certification

Section 302 requires a company’s CEO and CFO to personally certify, under penalty of law, that:

-

The financial disclosures are accurate and complete

-

They have designed or supervised internal controls

-

They have disclosed to the audit committee any material weaknesses or fraud

This includes disclosures related to intangible assets, such as patents.

If the company has listed expired, unassigned, or overvalued patents as key assets—or has failed to disclose material risks to enforceability—those issues can compromise the certification.

👉 Full text of Section 302 (SEC.gov)

Section 404: Internal Controls Over Financial Reporting (ICFR)

Section 404 requires management (and in many cases, external auditors) to assess and report annually on the effectiveness of internal controls over financial reporting.

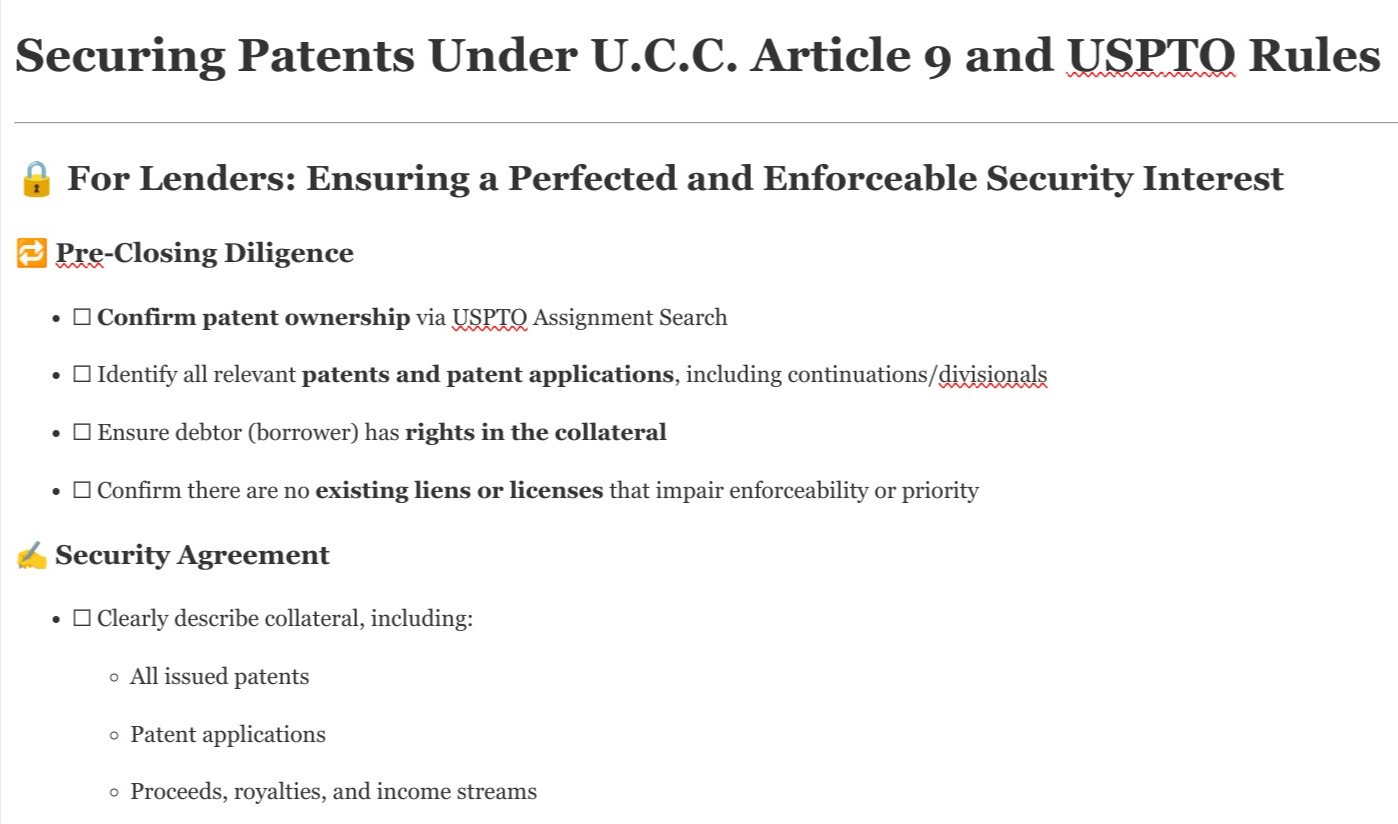

If your company includes patent portfolios in its balance sheet or risk disclosures, you must have internal controls in place to ensure that:

-

Patents are active, valid, and properly recorded

-

Assignments are legally complete and current

-

Valuations reflect legal and commercial realities, not just management assumptions

-

Risks to enforceability (e.g., reexaminations, litigation) are escalated

“Without controls, every expired patent on your books is a compliance failure in waiting.”

👉 SEC SOX 404 Guidance (SEC.gov)

What Could Go Wrong? Real-World Patent Disclosure Risks

-

A company discloses 200 patents in its 10-K, but 15 have lapsed due to non-payment of fees—asset value may be overstated

-

A key patent has been invalidated in court, but financials still project royalty streams—cash flow assumptions may be misleading

-

Licensing revenue is booked, but internal records don’t verify the chain of title—SOX 404 may be breached for lack of documentation

These are not abstract accounting issues. They go directly to the accuracy of filings signed and certified by your CEO and CFO.

SOX Liability Is Personal

If material misstatements are found in public filings, the SEC can bring actions not just against the company—but against individual officers who signed the certifications.

Penalties can include:

-

Civil fines

-

Disgorgement of bonuses

-

Officer and director bars

-

Criminal charges (in extreme cases of willful misconduct)

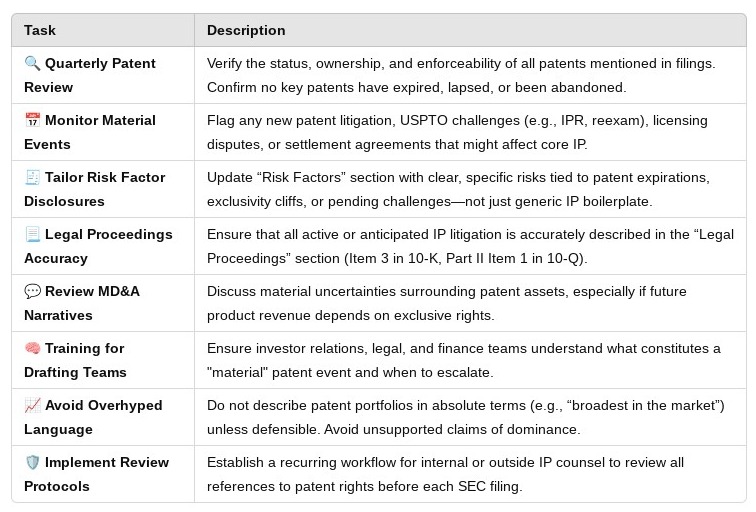

Action Plan: How to Strengthen Patent Disclosure Compliance

-

Inventory and Verify Patent Assets Regularly

Establish procedures to confirm that all reported patents are enforceable, assigned, and up to date. -

Integrate IP into Internal Controls

Treat patent reporting with the same rigor as inventory, revenue recognition, or tax liabilities. -

Train Legal and Finance Teams Jointly

Ensure cross-functional awareness of what’s required under SOX when disclosing IP-based value. -

Document Risk Assessments

When listing key patents in MD&A or risk factors, ensure the company can demonstrate it considered litigation, expiration, or regulatory threats. -

Audit Licensing and Royalty Streams

Confirm that income projections tied to IP are legally supportable and aligned with the current legal status of the rights involved.

Under SOX, Patent Reporting Is a Certifiable Risk

Patent portfolios are too valuable—and too legally complex—to be treated as mere line items. When they’re reported as material assets, Sarbanes-Oxley holds executive leadership directly accountable for their accuracy.

If your company’s reported patents are expired, misassigned, or impaired in ways the public filings fail to reflect, the liability doesn’t stop at the legal department—it lands on the signature page of your CEO and CFO.

“The integrity of your financials depends on the integrity of your IP reporting.”

Further Reading and Resources:

Additional Insights

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua