Complying with Rule 13-02(a)(4) under SEC Regulations

When Patents Are the Deal: Understanding Rule 13-02(a)(4) and Disclosure of Significant Assets

“If the acquired asset is a patent portfolio, then under SEC rules, it’s not just strategic—it’s reportable.”

In today’s innovation-driven economy, patents are increasingly at the heart of M&A transactions, guarantees, and affiliate arrangements. Whether a company is acquiring a tech firm for its intellectual property or guaranteeing obligations backed by patents, these assets may trigger specific disclosure requirements under the SEC’s Regulation S-X, particularly Rule 13-02(a)(4).

This rule isn’t widely known outside securities compliance circles—but for companies dealing in significant patent portfolios, it’s crucial. It governs how you must present and file financial and narrative disclosures when those patents are material to the structure or performance of the transaction.

What Is Rule 13-02(a)(4)?

Rule 13-02(a)(4) appears in Regulation S-X, which sets forth the form and content of financial statements required in SEC filings. This specific rule applies to registrants who provide financial statements or summaries for:

-

Acquired businesses

-

Guarantors or guaranteed securities

-

Affiliates whose securities are pledged as collateral

Under this provision, if the acquired or affiliated entity derives substantial value from identifiable intangible assets—such as a patent portfolio—the registrant must disclose the nature, significance, and potential risks of those assets.

👉 Full Rule Text (17 CFR § 210.13-02)

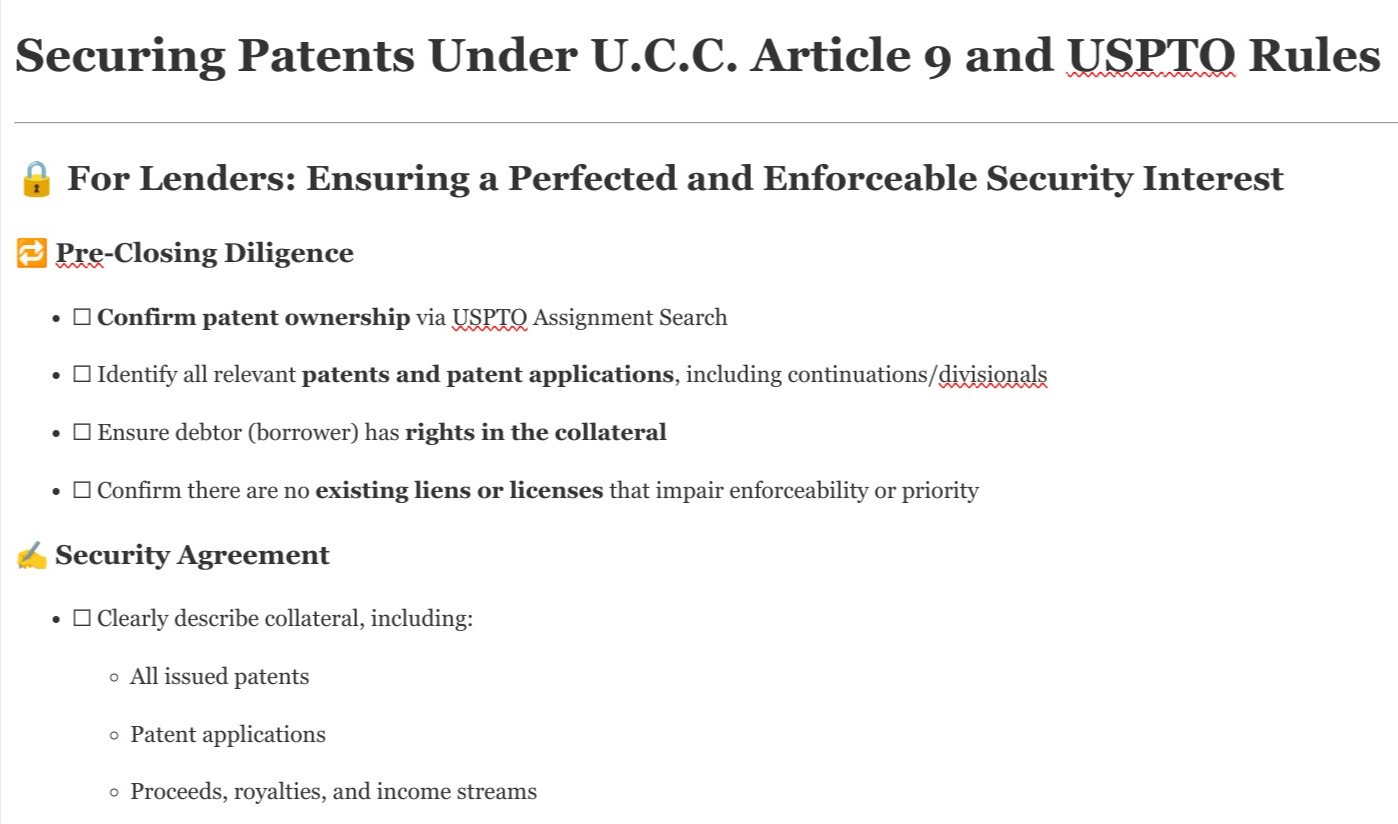

When Does It Apply to Patents?

Rule 13-02(a)(4) is most relevant when:

-

Your company acquires a target whose primary value is in its patent portfolio

-

You guarantee debt backed by a pool of patents or patent-holding affiliates

-

You are required to file separate financial disclosures for affiliates whose assets (including patents) secure securities

In these situations, the SEC expects not just line-item asset disclosures, but a clear explanation of the patent assets’ commercial significance, potential impairments, and legal status.

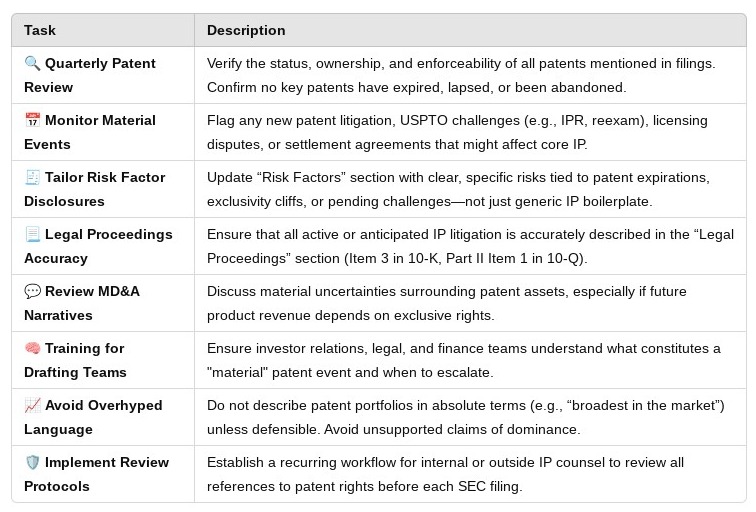

Key Disclosure Elements Required

Under Rule 13-02(a)(4), your filings must include:

-

A description of the intangible assets (e.g., specific patent classes or IP fields)

-

Their role in generating revenue or business value

-

Material risks associated with those assets, including:

-

Expiration or limited remaining term

-

Pending litigation or invalidation risk

-

Challenges to ownership or enforceability

-

-

Dependency of cash flows or guarantee recovery on those assets

“If your guarantee or acquisition is only as good as the patents behind it, the SEC wants to know how strong those patents really are.”

Example Scenario: Patent-Driven Acquisition

Imagine your company acquires a medtech firm whose core asset is a patented surgical device. The acquired company has no meaningful revenue apart from projected licensing deals tied to this patent.

Under Rule 13-02(a)(4), you must disclose:

-

That the value of the acquired entity hinges on a single patent

-

That the patent is set to expire in six years

-

That the USPTO has instituted an inter partes review that may affect its enforceability

-

That the patent’s assignment history is currently under legal dispute

Failing to disclose these elements risks SEC comment letters, amended filings, or even enforcement actions for misleading investors about the strength of the acquired business.

What’s at Stake?

If you omit or obscure patent-related disclosures under this rule, you may expose the company to:

-

Material misstatement risks under Rule 10b-5

-

Executive liability if inaccurate financial statements are certified under SOX

-

Securities Act liability under Section 11 or 12, if the information was included in a registration statement

-

Delayed M&A approval or post-close challenges from investors

“The SEC does not give a pass for complexity—if the value of the deal hinges on IP, the disclosure must hinge on IP too.”

Best Practices for Compliance

-

Assess the Materiality of Patents Early

During diligence, determine whether patents are the primary or secondary value drivers. -

Engage IP and SEC Reporting Counsel Together

Avoid disconnects between technical IP review and securities disclosure obligations. -

Draft Narrative Disclosures That Highlight Risks

Go beyond boilerplate. Describe litigation, expiration horizons, or claim limitations clearly. -

Tie IP to Cash Flow and Valuation

Help investors understand how patent strength links to expected future performance or debt recovery. -

Maintain Documentation for Audit and Review

Be prepared to defend your analysis if the SEC questions the sufficiency of your disclosures.

Don’t Let Patent Blind Spots Undermine SEC Compliance

When patents are the centerpiece of a deal, guarantee, or collateral arrangement, they must be treated as core financial assets, not legal footnotes. Rule 13-02(a)(4) requires registrants to tell investors how and why those patents matter, and what could go wrong.

If your next transaction rests on a key portfolio of patents, take the time to align your IP diligence with your financial disclosures. The SEC—and your investors—will be reading closely.

“If the patents drive the deal, they must drive the disclosure.”

Further Reading and Resources:

Additional Insights

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua