Regulation AB (Patent-Backed Securities)

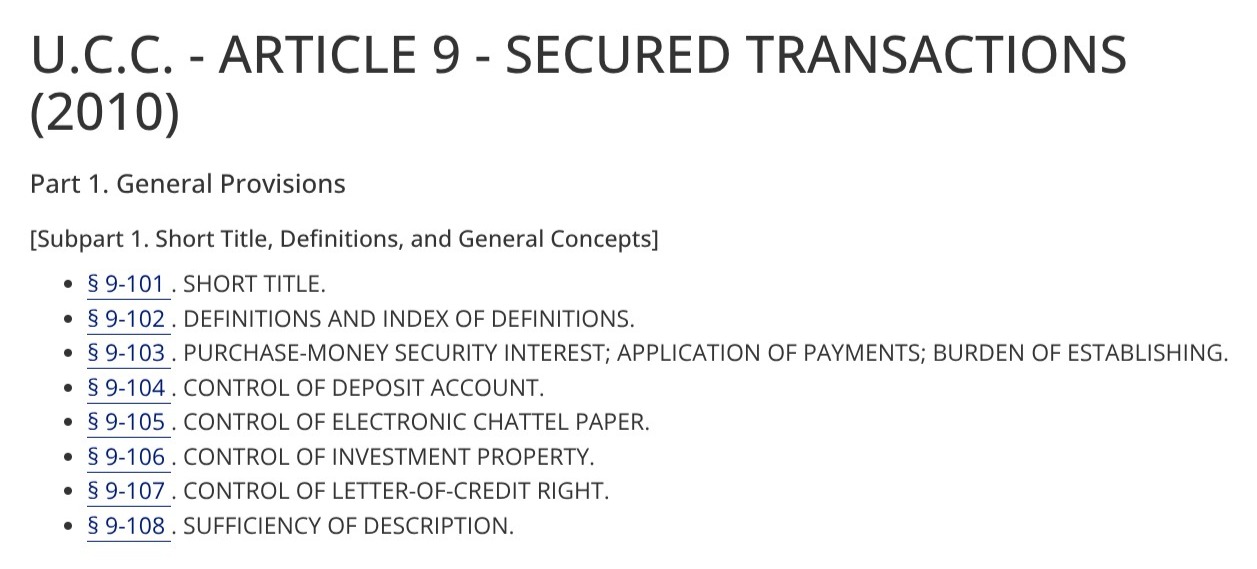

When patents are used as collateral in asset-backed securities (ABS) transactions, they are subject not only to commercial risk but to federal securities disclosure rules. In particular, Regulation AB, adopted under the Securities Act of 1933 and the Securities Exchange Act of 1934, imposes detailed obligations on issuers, underwriters, and due diligence providers to verify and report on the value and accuracy of collateral assets.

This includes intellectual property. And when the collateral consists of patents, mistakes can create legal exposure under Form ABS Due Diligence-15E, potentially affecting the marketability—and enforceability—of the securities.

What is Regulation AB?

Regulation AB governs the offering, disclosure, and reporting requirements for asset-backed securities (ABS). These are securities backed by pools of assets—traditionally loans, receivables, or leases—but increasingly, non-traditional assets like IP portfolios, including patents, are being securitized.

The goal of Regulation AB is to ensure investors receive standardized, transparent, and verifiable information about the underlying assets. That means patents used as ABS collateral must be accurately described, legally sound, and economically supportable.

The Core Requirement: Due Diligence on Collateral

Under Regulation AB, issuers and underwriters must conduct reasonable due diligence on the assets backing an ABS transaction. If a due diligence provider is retained, their review and findings must be disclosed by filing:

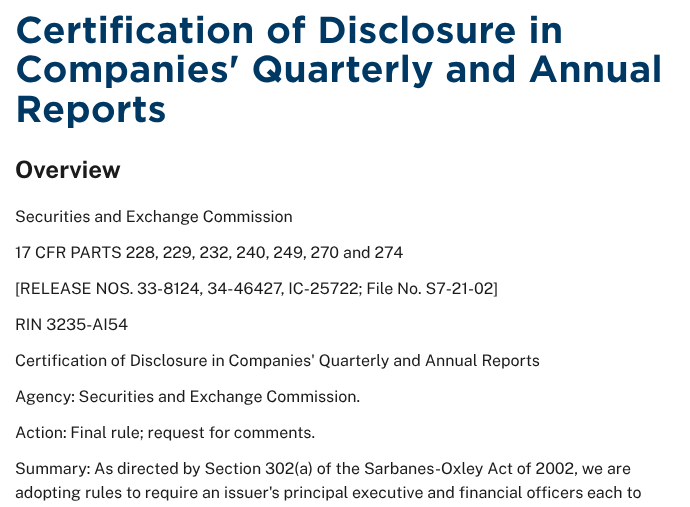

Form ABS Due Diligence-15E – SEC Rule 17g-10

This form requires an independent third party to report on the scope, methodology, and conclusions of their due diligence, including:

-

The accuracy of information about the collateral

-

The value and enforceability of the underlying assets

-

Any discrepancies, deficiencies, or red flags uncovered during review

When patents are included in the collateral pool, this review must address issues such as expiration, litigation, maintenance, title, and validity.

Why Patents Pose Unique ABS Risks

Compared to tangible assets or receivables, patents are dynamic legal instruments that require constant vigilance. They can expire, be invalidated, reexamined, lapse due to missed fees, or suffer from defective ownership. These complexities present serious risks in ABS offerings if not properly reviewed and disclosed.

Common patent-related pitfalls in ABS transactions:

-

Recording expired patents as active

-

Including unassigned or improperly recorded patents

-

Overstating the scope or value of a patent’s exclusivity

-

Failing to disclose pending litigation or USPTO proceedings

-

Treating patent applications as if they are granted patents

“If the collateral is mischaracterized, the entire security could be tainted—and subject to enforcement or rescission.”

What Form ABS Due Diligence-15E Requires

Form ABS-15E is not a mere procedural formality. It requires the filer to certify:

-

The identity and role of the party conducting the review

-

The level of review performed—including whether it included document-level verification, title checks, or valuation analysis

-

Whether the review was complete or selective

-

Any findings that materially affect the asset pool

View the form and its requirements directly here:

SEC Form ABS Due Diligence-15E (PDF)

Legal Exposure for Inaccurate or Incomplete Filings

If patent collateral is misrepresented—or if the due diligence fails to detect obvious defects—investors may bring claims under Sections 11 or 12 of the Securities Act, or under Rule 10b-5 of the Exchange Act (in cases of material omissions). The SEC may also initiate enforcement actions against issuers or underwriters for failure to comply with Regulation AB.

Further, a defective or deficient 15E filing could expose the due diligence provider to scrutiny, including under the Dodd-Frank Act’s anti-conflict-of-interest rules for third-party reviewers of structured products.

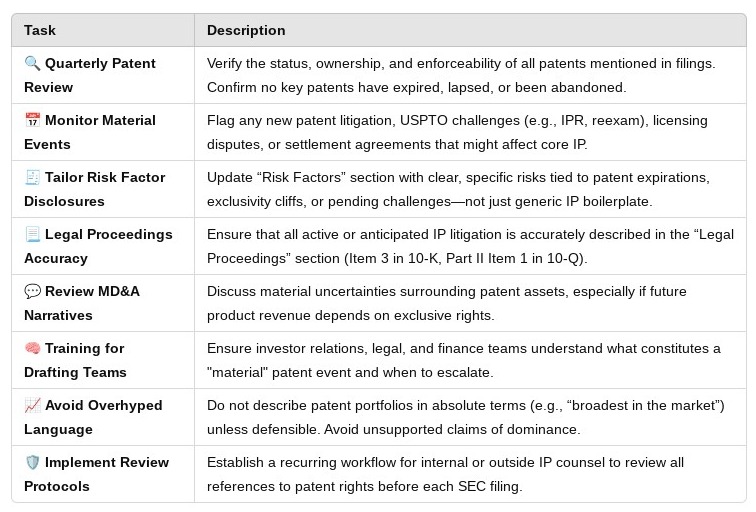

Action Items for Executives and Deal Teams

-

Vet All Patent Assets Included in ABS Pools

Ensure every patent is valid, assigned, and enforceable. Confirm legal ownership and maintenance status. -

Engage Experienced IP Diligence Providers

Use experts who understand how to evaluate patent enforceability, not just spreadsheet listings. -

Demand Comprehensive Due Diligence Reporting

Make sure your Form ABS-15E filers detail their methodology—and that their findings are clearly disclosed to investors. -

Disclose Known Weaknesses Up Front

If there is litigation, reexamination, or expiration risk, it must be disclosed clearly and early.

Regulation AB Requires Precision—and Accountability

As the ABS market evolves to include more intellectual property–backed deals, the legal infrastructure must evolve with it. Regulation AB—and in particular Form ABS Due Diligence-15E—is designed to force transparency in how collateral is verified and disclosed.

For executives overseeing ABS offerings that involve patent collateral, the message is clear: accuracy is not optional, and “good enough” due diligence will not suffice. A flawed collateral schedule can jeopardize an entire offering—and trigger long-term liability.

Further Reading and Resources:

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua