See the patent portfolio of your choice

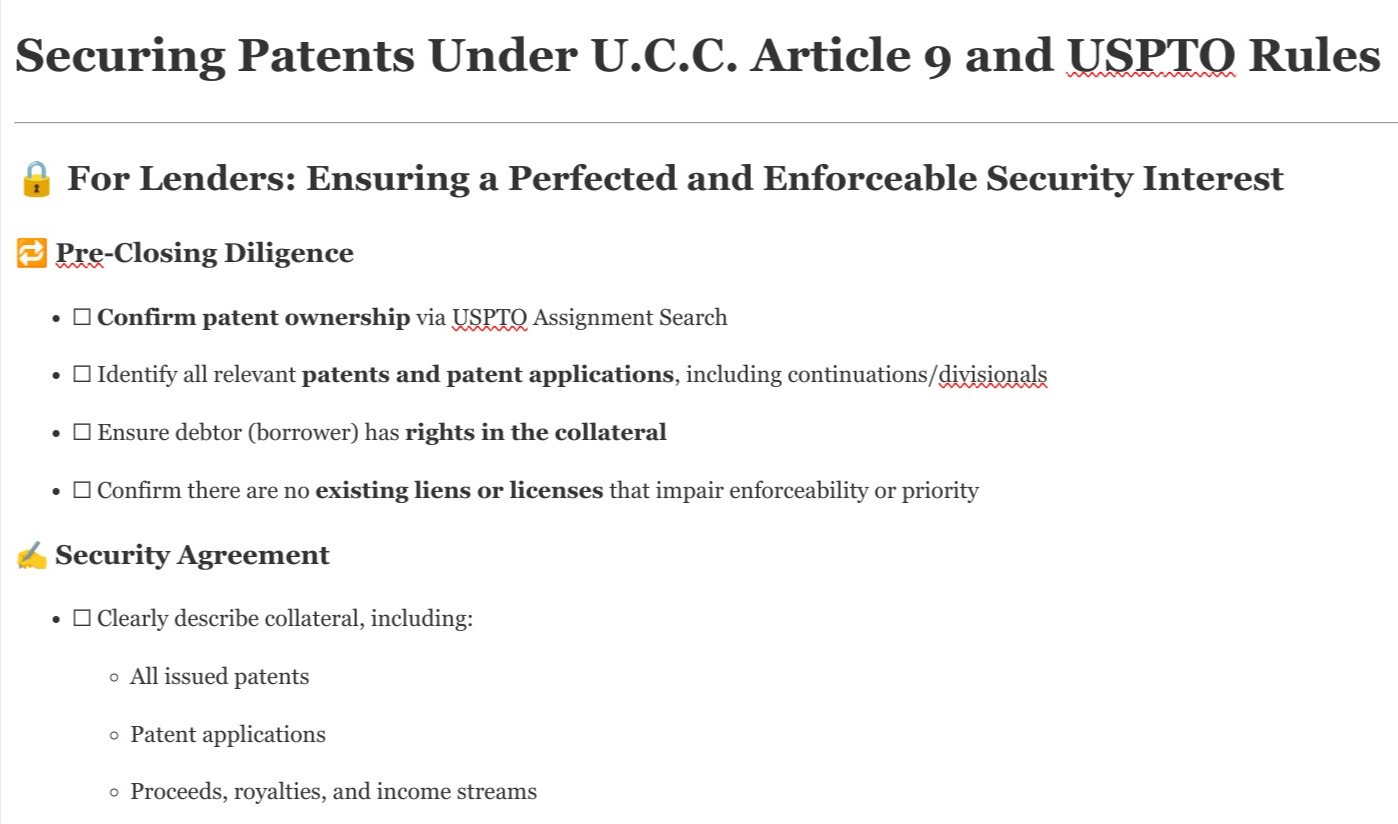

Patents are your company’s competitive edge—until they lapse from missed fees or defects, draining their value. Nortel Networks’ bankruptcy led to a $4.5 billion patent portfolio sale, a loss tied to maintenance failures that directors could have prevented. With only about half of U.S. patents maintained full term, this is a widespread risk you can’t […]

- Patent lawsuits can devastate your company’s finances, and as a director, you’re on the hook to safeguard shareholder value. The Polaroid Corp. v. Eastman-Kodak Co. case cost Kodak $90 million for infringing instant photography patents, while Apple Inc. v. Samsung Electronics Co., Ltd. racked up billions in damages over years. These financial hits aren’t rare—they […]

- As a board director, you’re juggling countless risks, but personal liability for patent infringement might catch you off guard. If you knowingly push your company to infringe, you could face legal consequences—cases like Windsurfing Int’l, Inc. v. AMF, Inc. saw a CEO held liable, and Mentor H/S, Inc. v. Evolving Systems, Inc. pinned a CEO […]

- Launching products without checking existing patents can land you in a legal mess, and directors are accountable for those oversights. Research in Motion (RIM) paid NTP $612.5 million in Research in Motion Ltd. v. NTP, Inc. after skipping due diligence—a preventable hit to the bottom line. Your duty of care demands better, or shareholders will […]

Your patents are strategic goldmines, but if you don’t tap them, you’re leaving money on the table. Texas Instruments held a GPU patent in 1991 but missed its full potential until Nvidia capitalized on similar tech years later—a classic case of underutilization. Directors who fail to maximize these assets shortchange shareholders and weaken competitiveness. PatenTrack […]

Without a coherent patent strategy, the company risks losing its competitive edge to generic entrants, facing costly litigation, or failing to capitalize on emerging therapeutic areas—all of which could materially impact shareholder value.

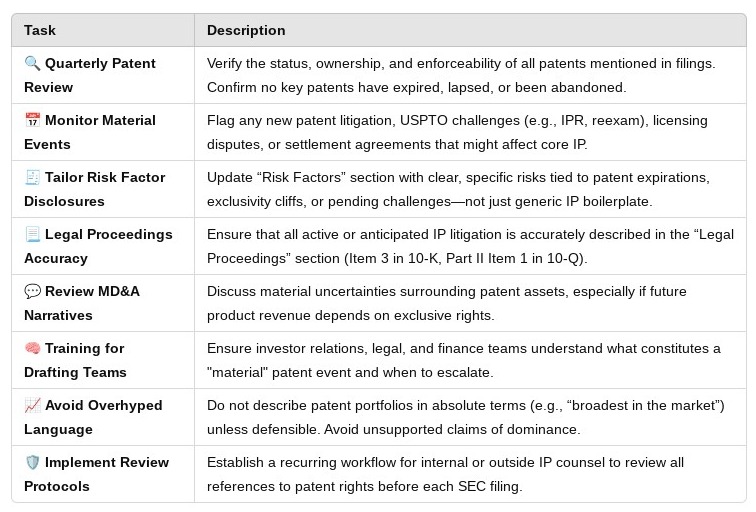

Under Caremark, you are responsible for ensuring that management has systems in place to assess and maintain the enforceability of the portfolio. This includes verifying that ownership is clear, maintenance fees are diligently paid, and encumbrances are identified and addressed—processes that must be robust enough to escalate significant issues to the board’s attention.

The Board of Directors hereby directs management to implement and maintain a Patent Portfolio Monitoring & Risk Disclosure System

The duty to implement and maintain internal controls for patent portfolios represents a fundamental Caremark obligation that extends to both directors and officers.

How would you evaluate whether your clients' current approach to patent strategy and budgeting would satisfy their Caremark obligations?

Addressing conflicts isn't merely about compliance—it's essential for patent strategy effectiveness.

In an era of increasing shareholder activism and heightened board accountability, patent portfolio valuation and reporting isn't optional—it's an essential component of fiduciary duty for innovation-driven companies.

Systematic risk management isn't merely defensive—it creates competitive advantages through greater operational certainty and leverage in business negotiations.

Patent enforceability hinges on effective maintenance fee management.

![Patent lawsuits can devastate your company’s finances, and as a [...]](https://patentrack.com/wp-content/uploads/2025/03/business-persons.png)

![As a board director, you’re juggling countless risks, but personal [...]](https://patentrack.com/wp-content/uploads/2025/03/business-development-ideas.png)