CAMELS-Based Oversight of Patent-Backed Loans

PatenTrack for OCC Examiners

Supporting CAMELS-Based Oversight of Patent-Backed Loans

Why It Matters:

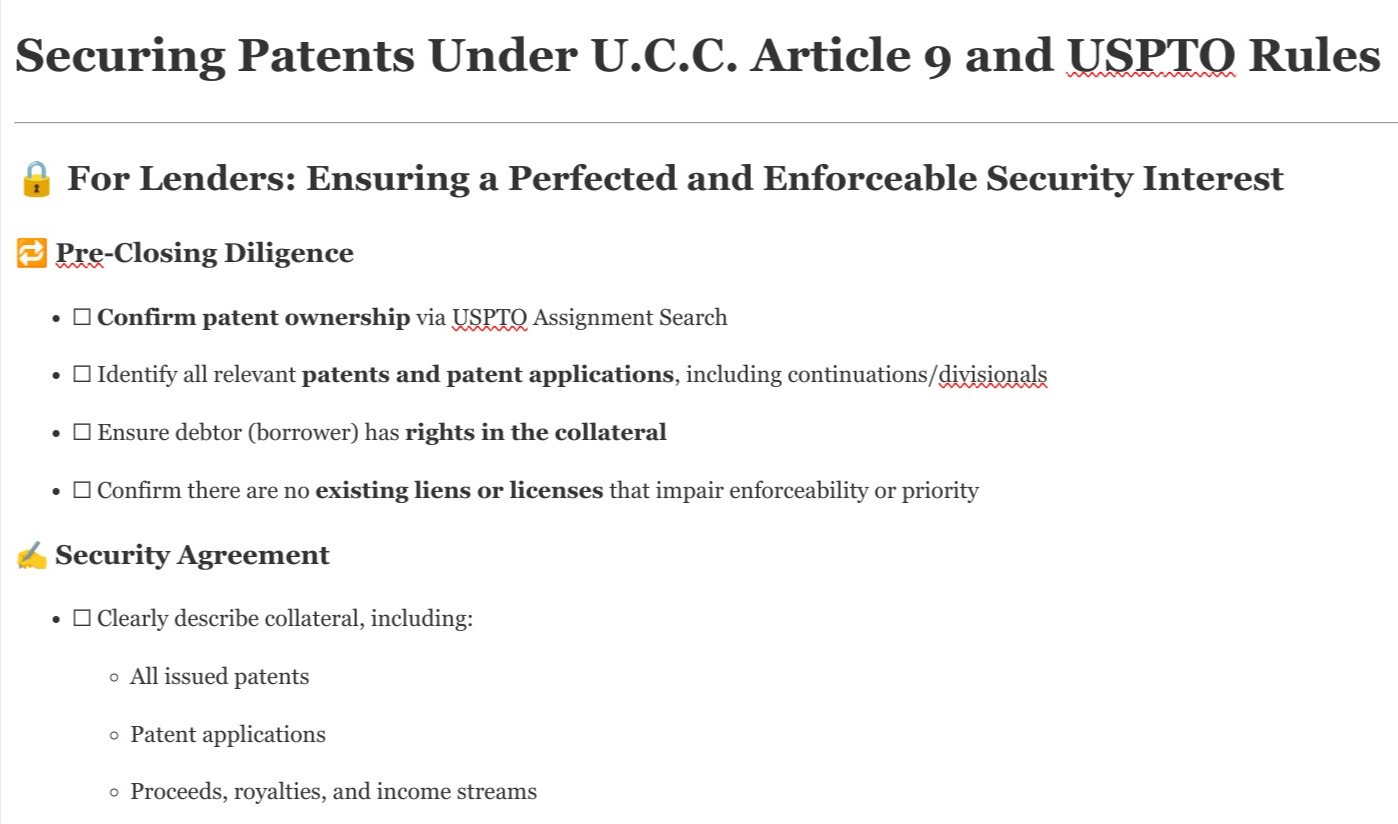

Under the CAMELS framework, Asset Quality and Management are key indicators of a bank’s safety and soundness. When banks rely on patents as loan collateral, those assets must be more than just documented—they must be real, enforceable, and continuously aligned with underwriting assumptions.

The Oversight Gap:

In practice, patent collateral is rarely revalidated after loan origination. As a result, many institutions fail to detect when a pledged patent:

- No longer exists

- Has lapsed or expired

- Is no longer owned by the borrower

- Is encumbered or legally impaired

These breakdowns directly affect loan quality and may result in under-secured or misclassified assets.

How PatenTrack Helps:

PatenTrack provides OCC examiners with visibility into the ongoing status of patent collateral—empowering you to:

- Detect weaknesses before they become criticized assets

- Evaluate management’s credit administration practices

- Support accurate loan classifications during exams

- Strengthen institutional compliance with prudential standards

Patent-backed lending presents unique risks that often go unchecked. PatenTrack helps you fulfill your oversight mandate—ensuring collateral truly secures credit and CAMELS assessments reflect reality.

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua