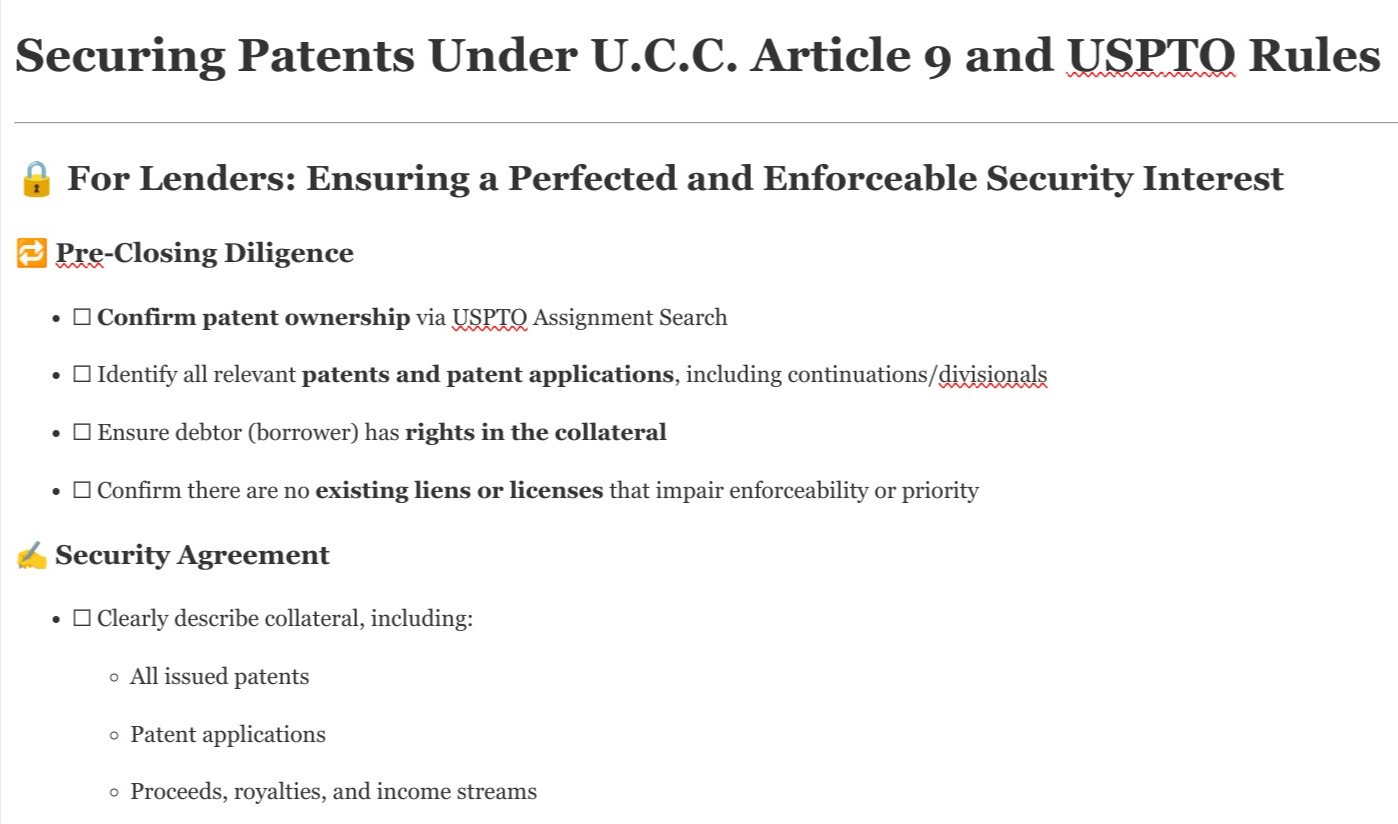

When patents are critical for the company’s sustainability, CFOs, CCOs, and CIPOs are required to make a long list of representations and warranties to ensure that their patents are valid, owned outright, and commercially viable to convince lenders of their value. Throughout the loan term, borrowers need to maintain patent integrity to avoid breaching covenants that could trigger default.

PatenTrack helps ensure you meet those expectations and avoid surprises that could jeopardize your current and future financing and operational flexibility.

The Board of Directors hereby directs management to implement and maintain a Patent Portfolio Monitoring & Risk Disclosure System

When patent collateral weakens post-closing, lenders are often the last to know. A quiet shift in LTV can throw off your risk model—and cost you hundreds of thousands in annual return. Here's how it happens:

In an era of increasing shareholder activism and heightened board accountability, patent portfolio valuation and reporting isn't optional—it's an essential component of fiduciary duty for innovation-driven companies.

Systematic risk management isn't merely defensive—it creates competitive advantages through greater operational certainty and leverage in business negotiations.

Defective title chains are a silent killer of patent value. Real-world cases like Ethicon and Tri-Star underscore the financial and legal fallout of oversight.

Patent ownership disputes often arise when companies fail to explicitly secure rights to inventions created by employees or contractors.

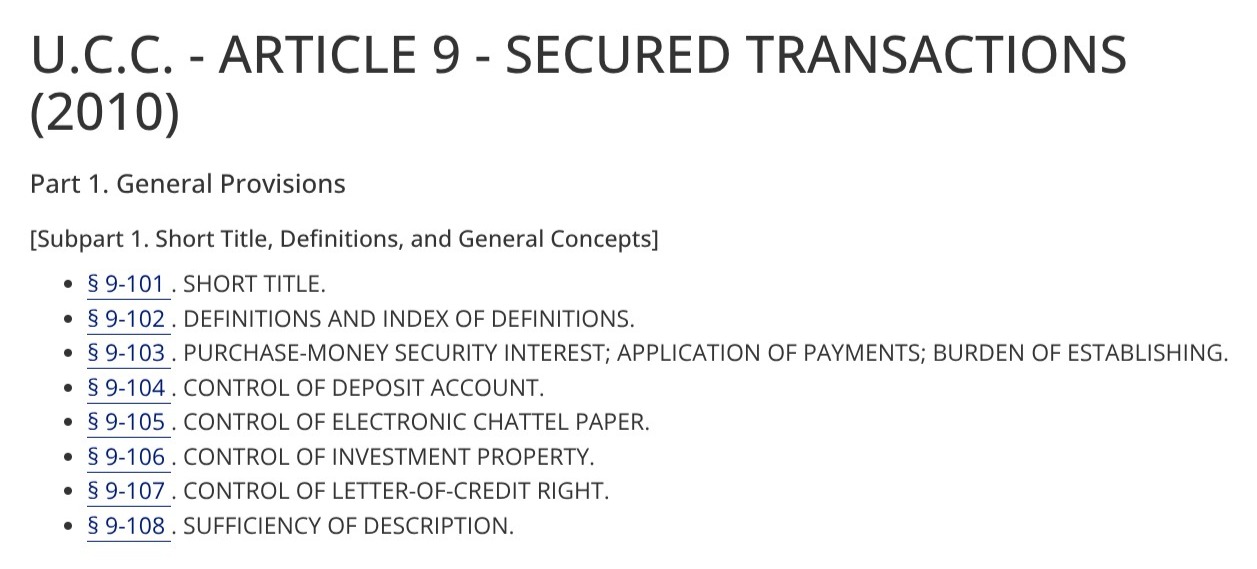

The complexities and risks associated with encumbrances necessitate a proactive approach, underpinned by advanced technological solutions.

Patent enforceability hinges on effective maintenance fee management.